Want to manage costs for international assignments effectively? Start here.

Budgeting for international assignments involves managing key expenses like salaries, relocation, daily living, and legal compliance. Here's what you need to know:

- Salary: Adjust for cost of living, housing, and mobility premiums.

- Relocation: Include moving costs, logistics, and initial setup.

- Daily Expenses: Account for housing, transport, education, healthcare, and home leave.

- Compliance: Cover visa fees, taxes, and legal requirements.

Steps to create a budget:

- Define assignment goals (duration, location, role).

- Research local costs (housing, taxes, education).

- Calculate expenses, adding a 10–15% buffer for surprises.

- Get approval from HR, Finance, and Legal teams.

Tips: Monitor exchange rates, inflation, and tax obligations regularly. Use digital tools like VisaDoc to simplify compliance and track costs.

Proper planning ensures financial control, compliance, and employee support.

Main Cost Categories

Planning for international assignments involves accounting for two major expense areas: employee compensation and living costs in the host country. Let’s break these down further.

Salary and Pay Structure

An employee's compensation package forms the backbone of any international assignment budget. Organisations generally follow one of two approaches:

| Approach | Description | Key Components |

|---|---|---|

| Home-Based | Keeps the home country salary with necessary adjustments | • Base salary • Cost of living allowance • Housing differential • Hardship premium (if needed) |

| Local-Plus | Offers a host country salary with extra benefits | • Local market salary • Mobility premium • Housing allowance • Education support |

Now, let’s look at the day-to-day expenses employees face while living abroad.

Daily Living Costs

Estimating daily living expenses accurately is crucial. These typically include:

- Housing: Rent, utilities, and maintenance costs

- Transportation: A company car or travel allowance

- Education: School fees for dependent children

- Healthcare: Medical coverage for the employee and their family

- Home Leave: Costs for regular travel back to the home country

These categories ensure a comprehensive approach to budgeting for international assignments.

Budget Creation Steps

Follow these steps to create an accurate budget for international assignments.

Set Assignment Goals

Start by outlining the key details of the assignment:

- Duration

- Host location

- Role and responsibilities

- Family status

- Expected outcomes

Gather Cost Information

Collect specific local cost data from trusted sources to ensure accuracy:

| Cost Category | Information Sources | Key Considerations |

|---|---|---|

| Housing | Local estate agents, relocation firms | Average local costs |

| Living Expenses | Cost-of-living databases, local HR teams | Daily expense benchmarks |

| Education | International schools | Standard fees |

| Tax Requirements | Tax advisors, local authorities | Income tax rates, social security contributions |

Once you’ve gathered the necessary data, you can move on to calculating total expenses.

Add Up Expenses

Start by calculating fixed costs like salary, housing, and schooling. Then, estimate variable expenses such as utilities, transport, and entertainment. Add a contingency buffer of 10–15% to cover unexpected costs. Use current exchange rates for conversions and consider inflation if the assignment exceeds 12 months.

Get Budget Approval

Submit a well-documented draft for review. Include cost data and market benchmarks, and ensure compliance with local wage and benefit laws. Obtain formal approval from HR, Finance, Legal, and relevant management teams.

With an approved budget in place, you’ll be ready to manage legal requirements and track expenses, which we’ll cover in the next section.

Following Rules and Managing Risks

Meeting Legal Requirements

To comply with regulations in the host country, focus on these key areas:

Tax Compliance

- Calculate income tax rates, social security contributions, and consider double taxation agreements.

- Plan and schedule quarterly tax payments to avoid delays.

Social Security Contributions

Check for bilateral social security agreements and account for contributions in both the home and host countries.

Tracking and Updating Costs

Regular cost monitoring helps you stay within budget and maintain compliance. Here's a breakdown:

| Monitoring Area | Frequency | Key Actions |

|---|---|---|

| Exchange Rates | Weekly | Track currency changes and adjust allowances. |

| Living Costs | Monthly | Review inflation rates and modify housing budgets. |

| Tax Obligations | Quarterly | Verify tax schedules and ensure timely payments. |

| Benefits | Bi-annually | Update benefit calculations as necessary. |

For seamless management, integrate these updates into your digital compliance tools.

Using VisaDoc for Compliance

Once costs are monitored, simplify compliance with digital platforms like VisaDoc. This tool enables organisations to:

- Access up-to-date visa requirements and automatically generate necessary documents.

- Track visa applications and renewal deadlines.

- Receive real-time alerts about regulatory changes.

Be sure to include these visa and immigration expenses in your financial plan:

- Initial visa application fees.

- Premium processing charges.

- Costs for document translation and certification.

- Immigration health surcharges.

- Legal review fees.

To stay organised, create a compliance calendar that highlights critical dates and budget checkpoints for the entire assignment period. This ensures all legal obligations are met without delays.

Budget Management Tips

Review Costs Monthly

Here’s a quick checklist to help you stay on top of monthly expenses:

Exchange Rate Monitoring

Keep an eye on exchange rate changes that could impact allowances and compensation.

Cost Category Analysis

Break down key expense areas every month, such as:

- Housing and utility bills

- Transportation allowances

- School fees (if applicable)

- Healthcare premiums

- Local tax requirements

Compare Market Rates

After reviewing monthly expenses, make sure your costs align with market standards. Stay competitive by:

- Checking salary surveys from trusted sources

- Looking at cost-of-living indices for specific regions

- Keeping tabs on local housing market trends

Use Digital Tools

Digital tools can simplify cost management and ensure compliance. Platforms like VisaDoc can help you:

- Automatically track visa-related expenses

- Create accurate cost forecasts

- Stay ahead of compliance deadlines

- Store expense records securely in digital formats

Consider using a centralised system that integrates with your financial software. This reduces manual data entry and lowers the chance of errors.

Keep Employees Informed

Automation is great, but clear communication is just as important. Regularly meet with employees to update them about spending, upcoming costs, allowances, and reimbursement processes.

Provide clear guidelines on what expenses are covered, deadlines for claims, required documents, and payment schedules. This ensures everyone is on the same page and avoids confusion.

Summary

Effective international assignment management hinges on careful budgeting and adherence to regulations. A well-organised cost management strategy helps maintain financial control and regulatory compliance. Here's how to keep international assignment budgets on track:

Cost Management Essentials

- Keep an eye on local market rates for housing, education, and other related costs.

- Track visa and immigration fees diligently.

- Maintain open and transparent financial communication with assignees.

These steps help minimise unexpected financial challenges.

Using Digital Tools

Platforms like VisaDoc simplify compliance and expense management by offering features such as:

- Efficient visa cost processing.

- Accurate expense forecasting.

- Ensuring immigration regulation compliance.

- Reducing administrative workload through automation.

Managing Risks

To avoid financial pitfalls, focus on these key areas:

- Monitor currency fluctuations to manage cost changes.

- Stay ahead of local tax obligations.

- Keep thorough records of all assignment-related costs.

Regular budget reviews, combined with strong communication between HR, finance teams, and assignees, ensure a seamless assignment process. This approach highlights the importance of staying proactive in managing finances for international assignments.

FAQs

How can I plan an international assignment budget that accounts for unexpected costs?

To create a reliable budget for an international assignment, it's essential to anticipate unexpected costs. Start by including a contingency fund - typically 10–15% of the total budget - to cover unforeseen expenses such as emergency travel, medical costs, or fluctuating exchange rates.

Additionally, research location-specific factors like tax regulations, cost of living, and potential visa-related expenses. Platforms like VisaDoc can help streamline visa processing and compliance, reducing the risk of unexpected legal or administrative fees. By planning thoroughly and staying informed, you can minimise surprises and keep your budget on track.

How can I effectively manage exchange rate fluctuations during an international assignment?

Managing exchange rate fluctuations is crucial to maintaining an accurate budget for international assignments. Start by regularly monitoring exchange rates using reliable financial tools or apps, ensuring you stay informed about any significant changes. Set a contingency fund in your budget to account for unexpected currency fluctuations, which can help prevent financial stress.

Additionally, consider using a multi-currency account or pre-paid currency cards to lock in favourable rates when possible. This approach can minimise the impact of sudden rate changes. For long-term assignments, reviewing and adjusting your budget periodically to reflect current rates is essential for staying on track.

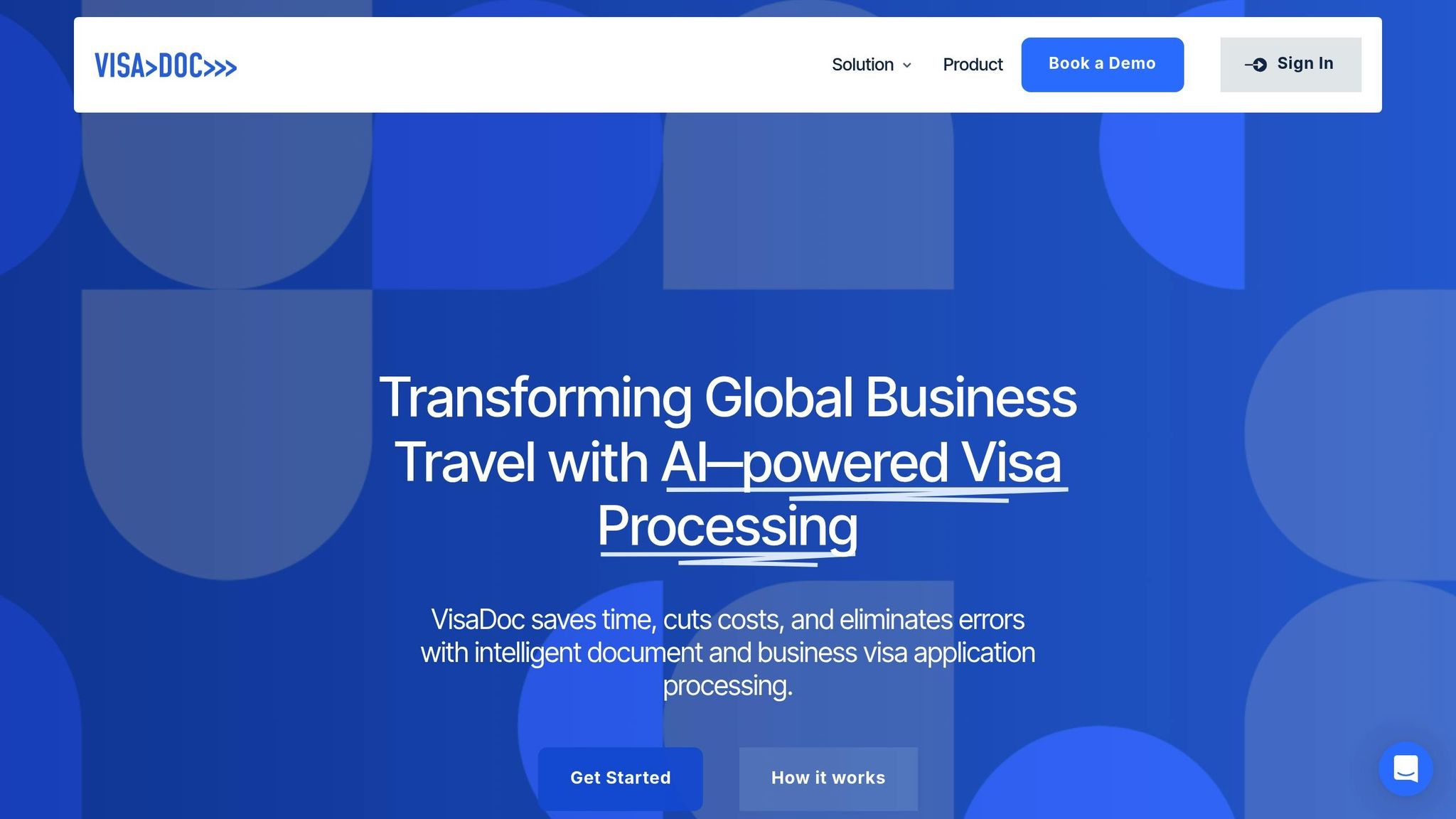

How can VisaDoc help simplify compliance for international assignments?

VisaDoc simplifies compliance by automating key processes such as document management, form completion, and validation. It ensures that applications adhere to the latest embassy requirements and regulations, reducing errors and delays.

The platform integrates seamlessly with existing systems, enabling HR and legal teams to manage visa applications efficiently while staying up-to-date with evolving rules. This not only optimises employee mobility but also helps organisations avoid potential legal issues and penalties.